Growth & Failure: Navigating through the business lifecycle

Whether you are a full-time entrepreneur or are building your side-hustle, you've likely heard the common phrase that '9 out of 10 startups fail'. While data proves that failure rates by venture-backed startups aren't quite as grim, the statistic of 60-79% is still pretty damn high. The next logical question you might be thinking is, why the heck do so many of these startups fail? Should I be worried? Many sources speculate the reasons. CB Insights collected some data from 101 startup failure postmortems and here are a few highlights:

42% indicated no market need (e.g. you think people will love your idea, but you didn't test it and they actually don't)

29% indicated they ran out of cash

23% indicated they did not have the right team in place

19% of the startup failures cited stiff competition

18% indicated pricing or cost issues

A few other interesting (but less frequently cited) reasons included failure to pivot, lack of passion, ignoring customers, burnout and lost focus. How do you avoid this kind of downfall in your own business? While there is no 100% fail-proof method, having a solid understanding of the business lifecycle will help arm you with the knowledge you need to manage each stage of your company's growth.

Business Lifecycle

As you head into the world of business ownership, understanding the lifecycle of a business can be hugely helpful. It puts your challenges in context to other businesses who've already gone through that phase of growth. It also shines light to the fact that what feels like unique to your company, might actually be somewhat of a predictable situation based on what stage of business growth you're currently in.

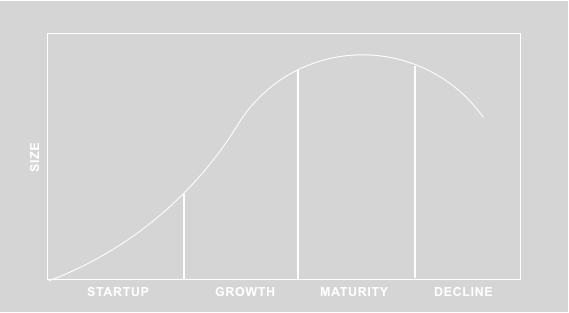

Figure A: Business Lifecycle

There are four general and somewhat predictable phases of a business lifecycle (as outlined in Figure A):

Startup: an innovative and iterative phase with respect to the product and/or services; heavy focus on exposure and securing meetings for potential sales. Processes aren't a massive priority at this stage.

Growth: a more stable phase that experiences predictable and consistent revenue and profitability. Establishing processes and securing key talent are hugely detrimental to a company realizing its full potential at this phase. Capital (through investors or debt) is also required.

Maturity: this likely the most secure and dependable phase that the company has experienced to-date. Revenue is predictable, operations are smooth and teams don't feel burnout. Reinforcing market position globally is not uncommon at this phase.

Decline: Cash flow has started to decline for the past few quarters. As the article states, "80% of businesses with less than $50 million in annual revenue never sell. Their owners don't acknowledge where they are in the business life spectrum or make a decision to change. By the time they decide to sell, their business isn't worth much to potential buyers" (a.k.a strike while the iron's hot).

Greiner's Growth Model

A man named Larry Greiner took the business lifecycle a step further and created a theory outlining each stage of business growth (published in HBR in 1998). This framework is particularly useful as a business grows and feels the subsequent growing pains of that particular phase. However, it falsely presents the concept that as a company grows in age it will definitively grow in size. D&Co believes that some companies perpetually remain in one phase (particularly in the early stages), continuously repeating the same struggles over and over. The Figure B demonstrates where we believe the Greiner Growth Model (in blue) lives with respect to each phase of the business lifecycle model:

Figure B: Greiner Growth Model overlay to Business Lifecycle

The Greiner Growth Model includes (6) phases of growth followed by a 'turning point' at the completion of each phase, which presumably launches it into the next phase as outlined below. At D&Co, we tend to focus on supporting businesses in the first and/or leaning closely to the second growth phase.

Growth through creativity: much like the previously mentioned 'startup' phase, this phase is largely composed of innovation, creation, reaction and somewhat of disorganization. Throwing ideas out there and seeing what sticks. There is a certain level of informality that's accepted at this phase coupled with long hours of committed employees with a vested interest in the company's success. Business owners at this stage are very 'hands-on' and in the weeds of the day to day. But, 'who will lead the company out of the confusion?' -- there is only so much that employees will take, which leads to the first revolution:

→ Leadership Crisis : new business techniques are required, which provide organization and structure. Business owners who led the company through the initial creativity phase may not want to loosen their reins despite the fact that their creative skillset is not what is truly required now.

Growth through direction: sustained growth is typically experienced after a company introduces functional structure. Roles and responsibilities take higher precedence here and assignments are more specialized. A sense of hierarchy might be introduced with this form of growth and communication becomes more formal.

→ Autonomy Crisis: As growth through direction continues, processes become numerous, disjointed knowledge between middle and top management increases and it becomes difficult for people to take on so many roles and responsibilities on their own. This sparks the next phase of growth through decentralizing these responsibilities through delegation.

Growth through delegation: this phase of growth embraces decentralization by providing autonomy to middle managers, centralizing headquarters and upper management and removing day to day responsibilities from those executives. Essentially middle management is empowered to expand operations through their own means and areas of expertise. Top management tends to feel very disjointed, which leads to:

→ Control Crisis: Top management essentially feels as though they are losing the control. Some are like, "jk, lol we actually want to be the boss again" and those firms typically fail. Others adopt stronger coordination and structure so the firm can experience the next level of growth:

Growth through coordination: product groups are created and certain functions become centralized while daily operational decision making remains decentralized. Corporate goals are established and formal systems are introduced, which lead to massive bureaucracy and stagnant upward trajectories.

→ Red Tape Crisis: Innovative problem solving feels lost and frustration occurs at a management level, because there is essentially a lack of common sense and humanity with respect to making decisions (e.g. processes hinder progress). Culture becomes more important.

Growth through collaboration: companies introduce more flexibility regarding decision-making and the bureaucratic issues are resolved with a focus on more interpersonal collaboration and a behavioral-focused approach.

→ Internal Crisis: At this point, it's important to note that the Greiner article published in 1998 ended with the fifth phase of growth and speculation as to what might come next. He later added this 'crisis' and the subsequent growth phase:

Growth through alliances: this phase indicates that an organization must seek partnerships with complementary organizations in order to enable growth, this can be achieved through mergers, acquisitions outsourcing or other solutions.

At this point Greiner's model ends here, without further defined crises. However, other articles have referenced an 'identity crisis' that may occur. If you've ever worked at a firm that has gone through a merger or acquisition, you might've experienced this - whether it's through a lack of clear communications, misaligned strategies and/or a transition period where the two are coming together as one united and unified firm. This is what we presume the 'identity crisis' phase is all about. Other articles suggest that at this point companies cycle back through earlier growth phase crises.

D&Co POV

While the business lifecycle and the model of growth developed by Greiner may feel pretty academic, the perspective each framework offers helps put your business challenges in context and arm you for the next stage of growth. But the evolution of technology is revolutionizing businesses and consequently the various stages of growth and/or crises they experience. As small business owners operating in today's world, we may find that access to technology provides us with tools and resources that allow us to stay more organized from the get-go. We may also leverage growth through strategic and complementary alliances to keep overhead costs lower, but reach wider. Access to these kinds of systems and external resourcing may potentially disrupt the sequential order of growth that Greiner outlined and it may also introduce some of the later phased issues earlier on.

What do you think? Do you find the growth framework/ model by Greiner to be helpful? What experiences have you had that are aligned to these phases? Comment below!